Top Tip: Always Take Out Travel Insurance

In a world where the unforeseeable seems to be the norm, it’s important to be as prepared as possible, and that’s why we at Poe Travel cannot stress enough how important it is to take out travel insurance.

Before you can find yourself in relaxing scenes like this, it’s important to think about travel insurance (photo credit: Simon Migaj)

Whether you’re traveling under the best-case, most stress-free, optimal conditions or traveling in a world full of uncertainty (hello, 2020!), a solid travel insurance policy can give you the peace of mind you need when you’re on the go. At Poe Travel, we use Travel Guard (AIG Travel), and we have always found them to be top-notch.

During the pandemic, there was lots of confusion as to what was and wasn’t covered under travel insurance, so we don’t blame you if you’re confused too. For example, when flights were canceled by airlines, the airline was responsible for refunding clients or providing travel credits, so that did not fall under travel insurance coverages. The same is true of hotels or on-sites in various countries. This is why travel insurance wouldn’t have applied as much during the pandemic as it might usually.

It’s very important to note, however, that under most policies, if you were to contract COVID-19 prior to your travel, rendering you unable to travel, this would be a covered reason under the plan’s Trip Cancellation coverage. Similarly, if you contract COVID-19 while on the ground abroad, this would be covered under your medical expenses in most policies. It’s always important to check specifics on your policy, but all-in-all, COVID-19 is treated like any other medical emergency.

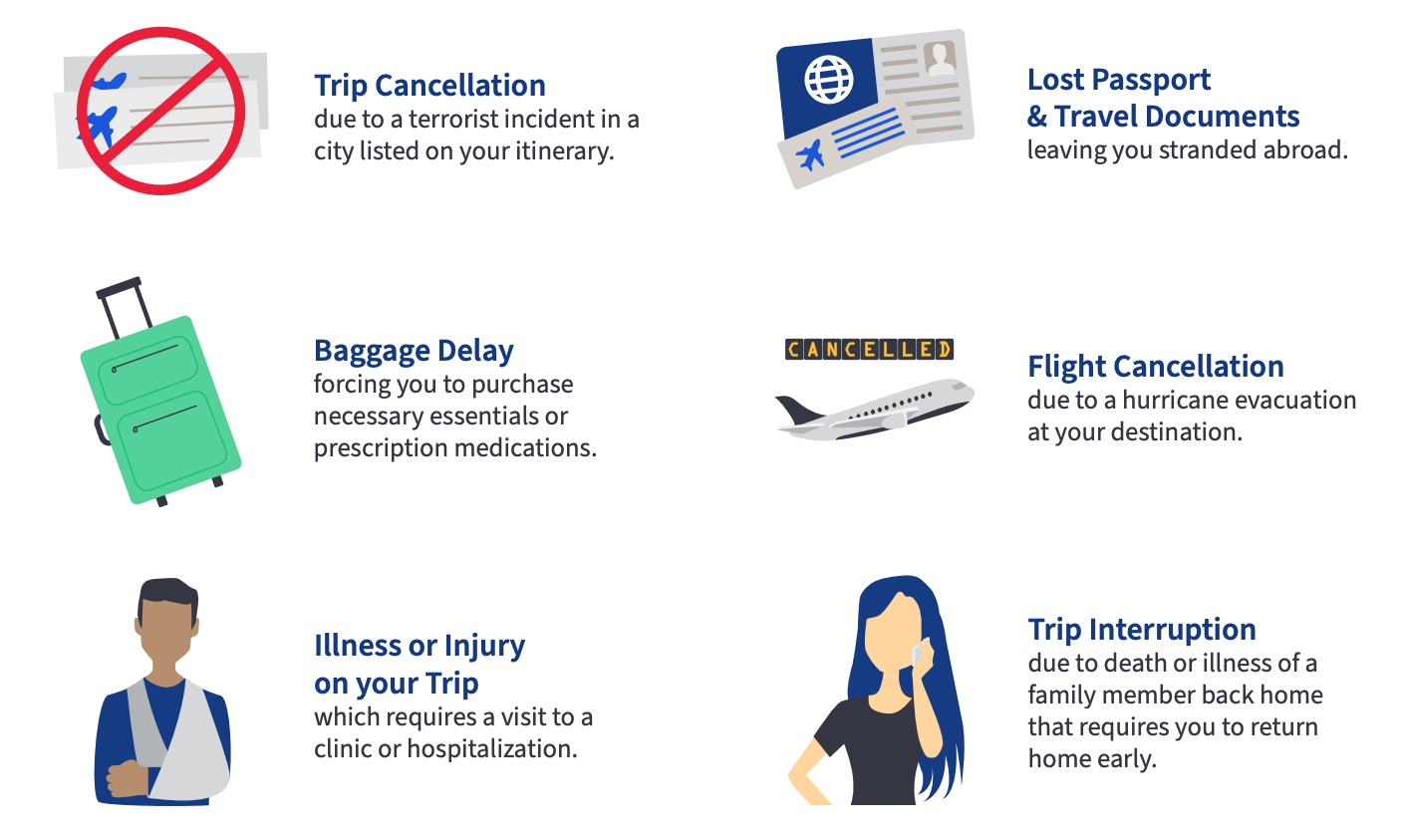

Here are some examples of instances in which travel insurance could prove extremely important. This isn’t a comprehensive list, but it will give you an idea of unforeseeable problems that travel insurance will help to fix, and if we have learned anything from this year, it should be that unforeseeable problems definitely like to rear their ugly heads from time to time:

Photo credit: Travel Guard/AIG Travel

None of these are things we like to think about when we talk about travel; they’re what we would class as travel nightmares. However, they’re sometimes unavoidable and very real parts of travel, so it’s always best to be prepared, and that’s where our trusted friends at Travel Guard come in, making sure that our clients are always protected as best as can be.

An Honor from Forbes for Travel Guard (AIG Travel)

In very exciting news, AIG Travel and Travel Guard were listed as Forbes’s Best Travel Insurance Company of 2020, with a 5-star rating. The top scoring plan was the Travel Guard Deluxe Plan. Here are the reasons Forbes says they picked this plan out of the many available in the travel world:

Top-notch for trip cancellation coverage, with up to $150,000 in reimbursement

Excellent coverage for medical expenses and emergency medical evacuation

Can cover pre-existing conditions that flare up during a trip

Inconveniences covered include hotel infestation, runway delays, and closed attractions

The plan’s “cancel for any reason” coverage lets you receive 50% reimbursement for cancelling the trip for any reason, at your discretion, as long as it’s cancelled at least 48 hours in advance of departure

The “cancel for any reason” coverage is a great reason to choose a more deluxe plan. You won’t see that sort of coverage in a more basic policy, but especially in these uncertain times, this sort of coverage is a huge weight off of you as a traveler as you prepare for your upcoming trips.

We always recommend taking out travel insurance as soon as possible after we book your airfare or after you make a deposit on a trip. This is because certain coverages (such as “cancel for any reason” or pre-existing conditions) are only included in the policy if you purchase the policy within 15 days of your initial deposit. This varies from plan to plan, and our agents will always have the best advice for you as to when to book your travel insurance to make sure all your bases are covered and can also provide you with a range of quotes if needed. This is yet another benefit to working with an experienced, knowledgeable travel agent, and those are the only kind we have at Poe Travel!

As a side note, there are some wonderful options should you want a little extra protection during these troubling times. Repatriation insurance available through COVAC Global will ensure that, should you be diagnosed with COVID-19 on your travels, you can be picked up by a medically-equipped jet and returned home. This would be an added benefit and of course come with an extra cost, but if you’re looking for some additional peace of mind, this could be the option for you.

When you book a trip with us, we want you looking forward: imagining the food you’ll eat, the wine you’ll drink, the adventures you’ll have. We don’t want you worried about the nitty gritty details, especially in times like these, and travel insurance will help to alleviate your worries, which is why we will always recommend it for any trip, however big or small!

Please note: all travel insurance coverage is policy-specific, so while we have discussed some general benefits to travel insurance, it is very important that you review your specific policy/quote with your travel advisor to understand your coverages.

If you want to get away anywhere in the world, simply contact us, and we will set you on your way (with a fabulous travel insurance policy to boot!).